Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

There is no specific form or document named "1040n" that exists in the U.S. tax system. However, it may be a typographical error or a reference to a particular situation related to taxes. If you can provide more context or clarify the intended reference, I can try to assist you further.

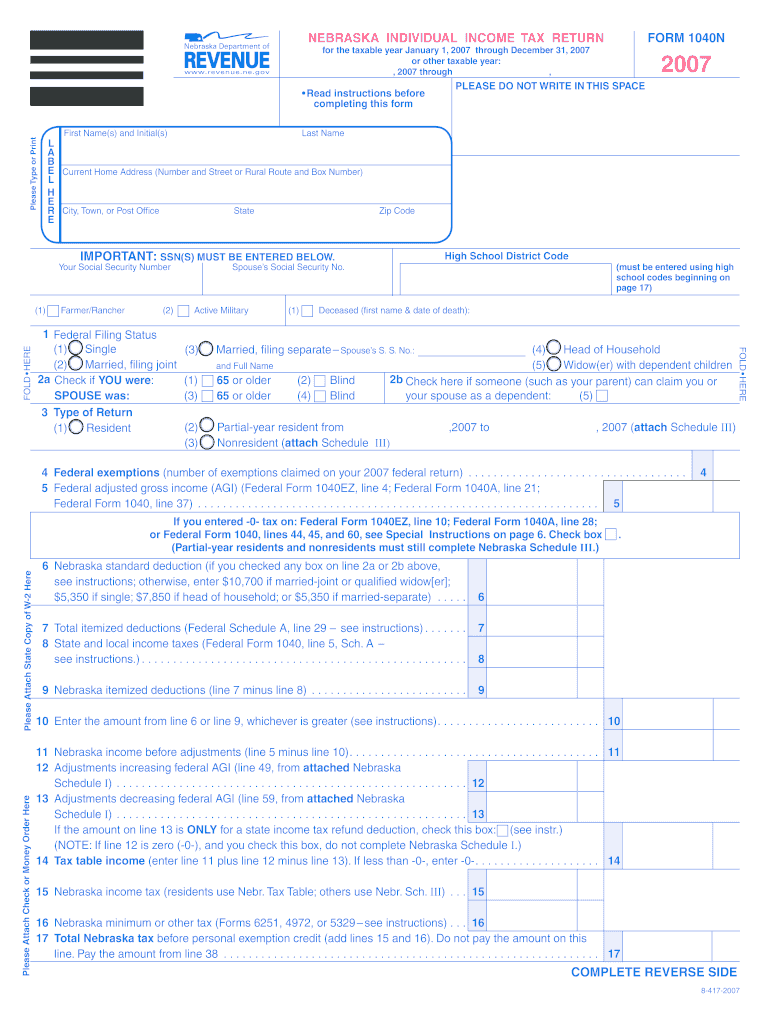

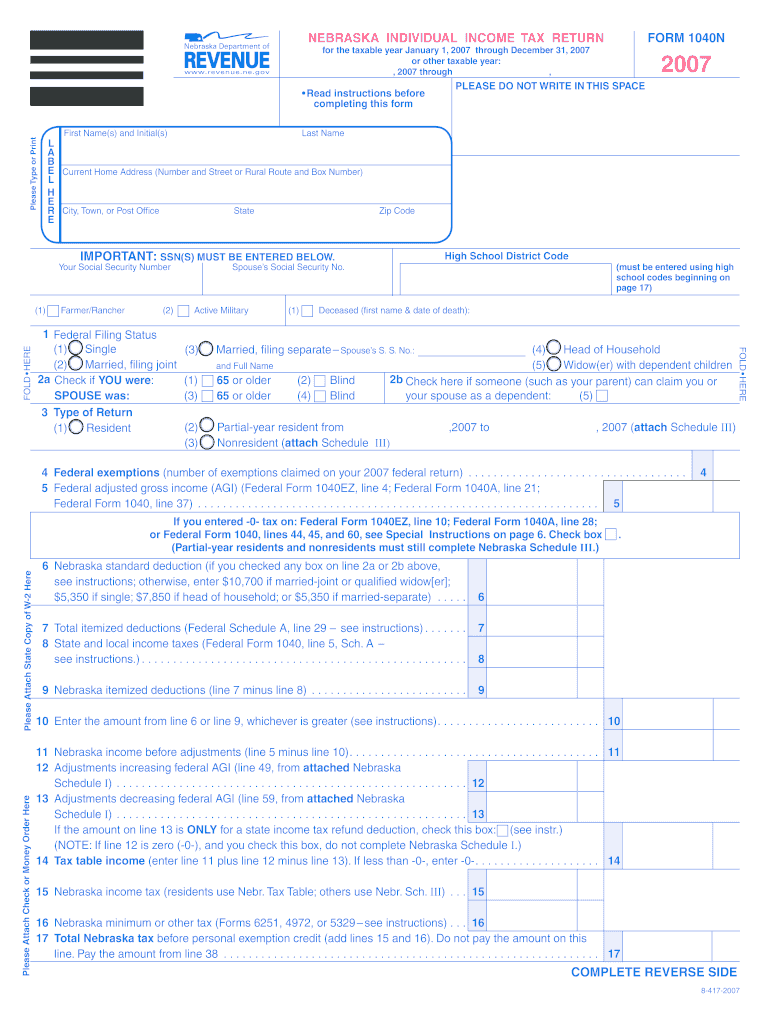

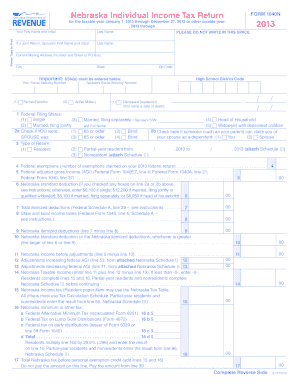

Who is required to file 1040n?

The 1040N form is used for filing individual income tax returns in the state of Nebraska. Thus, individuals who are residents of Nebraska and have income that is subject to Nebraska state tax are required to file Form 1040N.

Filling out the 1040NR form requires the following steps:

1. Begin by providing your personal information, including your name, address, and social security number or individual taxpayer identification number.

2. Indicate your residency status as a nonresident alien by checking the respective box on the form.

3. Enter your income details in the appropriate sections of the form. This includes wages, salaries, tips, and other compensation you received, as well as any taxable interest, dividends, or business income. Ensure you report all income from U.S. sources accurately.

4. Deduct any applicable exemptions and deductions, such as the standard deduction or itemized deductions like medical expenses or state and local taxes. Consult the instructions for the specific deduction amounts and eligibility criteria.

5. Calculate your taxable income by subtracting your deductions from your total income. Use the Tax Table or Tax Rate Schedule provided in the instructions to find your tax liability based on your taxable income.

6. Report any credits you are eligible for, such as the Foreign Tax Credit, Child Tax Credit, or Education Credit, by completing the relevant sections of the form. Follow the instructions carefully to accurately calculate each credit.

7. Determine your total tax liability after applying any credits. If you withheld taxes during the year, report the total amount in the appropriate section and compare it to your calculated tax liability. If the withheld amount is higher, you may be eligible for a refund. If it is lower, you will need to make an additional payment.

8. Complete the rest of the form, including any additional schedules or forms required based on your specific circumstances. Make sure to sign and date the form.

9. Gather any additional supporting documentation, such as W-2s, 1099s, or other proof of income or deductions, and attach them to your completed 1040NR form.

10. Mail your completed form and supporting documents to the appropriate IRS processing center. Ensure you use the correct mailing address provided in the instructions for your specific situation.

Note: The tax filing process can be complex, especially for nonresident aliens. It is advisable to consult with a tax professional or utilize tax software to ensure accuracy and compliance with U.S. tax laws.

What is the purpose of 1040n?

There is no specific form called 1040n. The Internal Revenue Service (IRS) provides Form 1040 for individuals to report their annual income and calculate their federal income tax liability. However, some states may have their own version of Form 1040 with a different suffix, such as 1040n, which is specific to that state's income tax reporting. The purpose of a state-specific 1040n form would be to report income, deductions, and calculate state income tax liability for residents of that particular state.

What information must be reported on 1040n?

Form 1040-NR is used by non-resident aliens to report income earned in the United States. The following information must be reported on Form 1040-NR:

1. Identification Information: This includes your name, address, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), filing status, and country of residence.

2. Income: Report all income earned from U.S. sources, including wages, salaries, tips, self-employment income, rental income, interest, dividends, and capital gains.

3. Deductions: Non-resident aliens are generally not eligible for the same deductions as U.S. citizens or resident aliens. However, certain deductions such as educational expenses, business expenses, and some itemized deductions may be claimed.

4. Exemptions: Non-resident aliens cannot claim personal exemptions for themselves or their dependents. However, certain exemptions may apply based on treaty provisions or other specific circumstances.

5. Tax Credits: Report any tax credits for which you may be eligible, such as the foreign tax credit, child tax credit, or education credits.

6. Withholding: If any taxes were withheld from your income, report the amounts on the appropriate lines.

7. Other Information: Form 1040-NR also requires you to provide additional information, such as details about any treaty benefits claimed, the number of days spent in the U.S., and any special circumstances related to your tax situation.

It’s important to note that this is a general overview, and the specific requirements may vary depending on the individual's circumstances.

When is the deadline to file 1040n in 2023?

The deadline to file Form 1040 (the standard individual income tax return form in the United States) for the year 2023 would be April 17, 2024. This is the usual deadline, unless it falls on a weekend or a public holiday, in which case the deadline could be shifted to the following business day. However, it's important to note that Form 1040N is not a standard form, and the deadline for filing this specific form may vary depending on the specific requirements and regulations of your state or locality.

How do I modify my 1040n in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your nebraska tax return form form 1040n and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I complete form 1040n online?

Completing and signing 1040n form online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I complete 1040n instructions on an Android device?

Complete 1040n tax form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.