Get the free 1040n

Show details

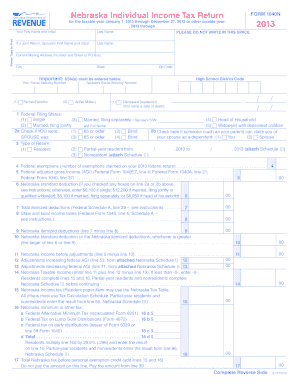

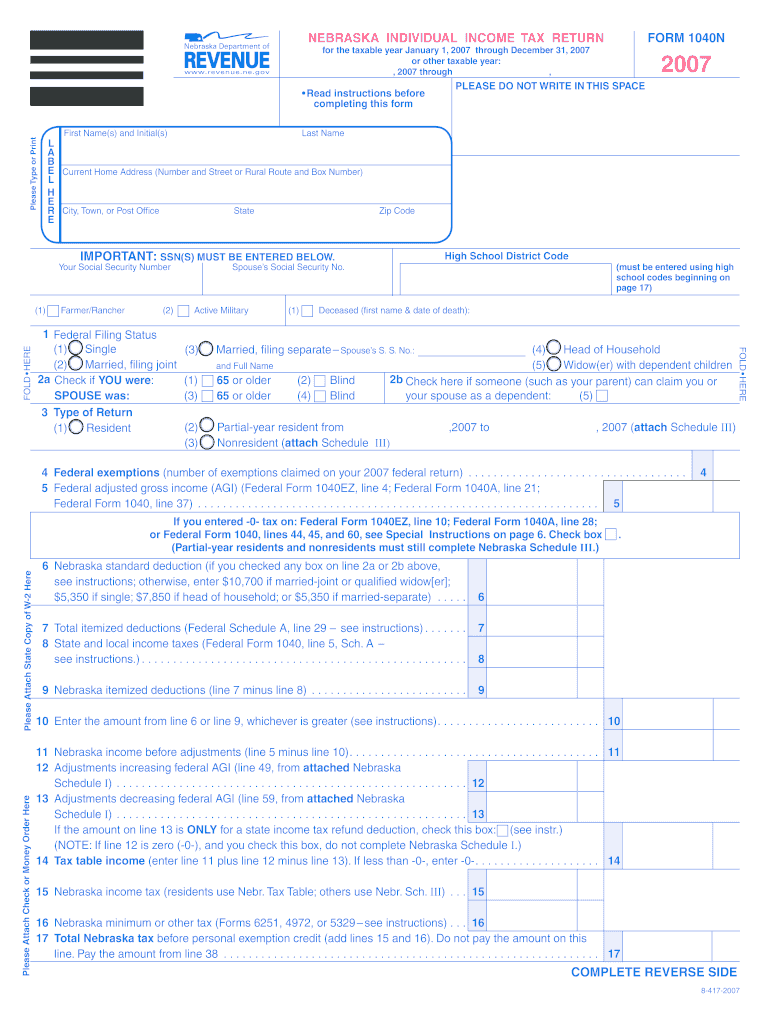

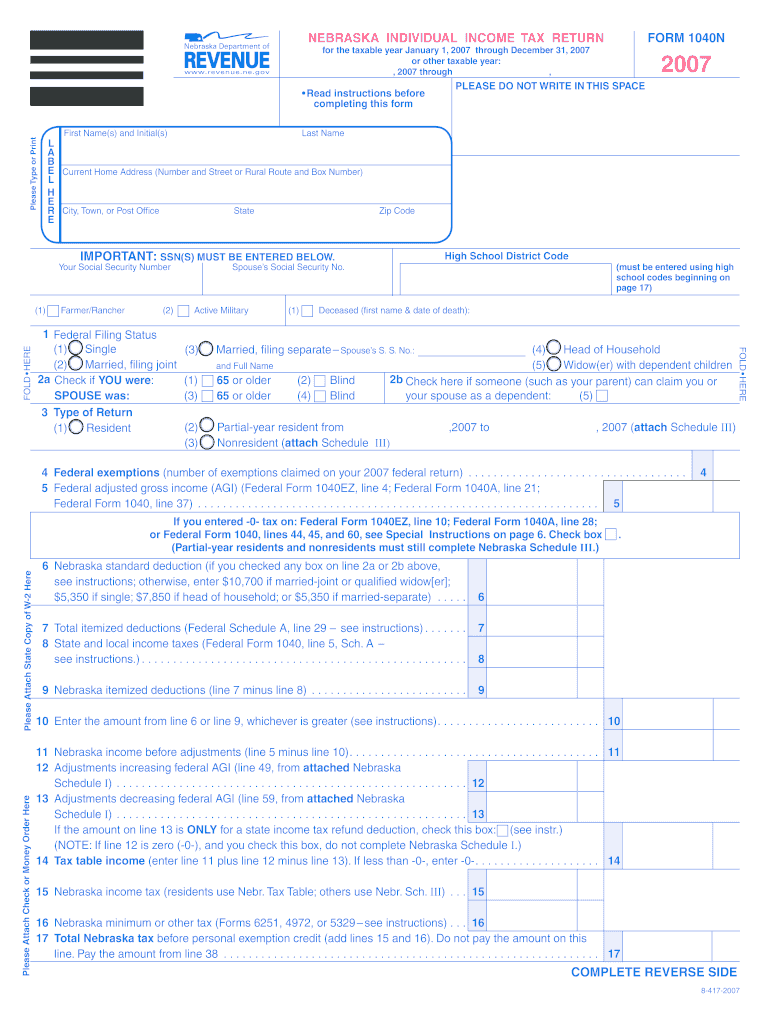

FORM 1040N NEBRASKA INDIVIDUAL INCOME TAX RETURN for the taxable year January 1 2007 through December 31 2007 2007 through Read instructions before completing this form First Name s and Initial s Last Name Please Type or Print RESET Farmer/Rancher must be entered using high school codes beginning on page 17 Deceased rst name date of death Head of Household Widow er with dependent children 2b Check here if someone such as your parent can claim you or your spouse as a dependent Married ling...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 1040n

Edit your individuals who are nonresident aliens required to file form 1040n form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nebraska 1040n instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1040 n online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 1040n form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1040n tax form

How to fill out 1040n:

01

Gather all necessary documents such as W-2 forms, 1099 forms, and any other relevant income statements.

02

Start by entering your personal information, including your name, Social Security number, and address, in the designated fields on the form.

03

Proceed to report your income in the appropriate sections of the form, ensuring that you include all taxable income and accurately calculate any deductions or credits.

04

Complete the sections related to exemptions, adjustments, and credits, taking note of any specific instructions or requirements provided.

05

After filling out all necessary information, carefully review the form to ensure accuracy and completeness.

06

Sign and date the form before mailing it to the appropriate address, as indicated in the instructions for Form 1040n.

Who needs 1040n:

01

Individuals who are nonresident aliens for tax purposes in the United States may need to file Form 1040n.

02

Nonresident aliens who have any U.S.-sourced income or who are eligible for certain exemptions, deductions, or credits may be required to file Form 1040n.

03

It is recommended to consult the Internal Revenue Service (IRS) or a tax professional to determine if you need to file Form 1040n based on your specific circumstances.

Fill

nebraska 1040n

: Try Risk Free

People Also Ask about nebraska form 1040n

Should I file 1040 or 1040NR?

IRS Form 1040NR is a tax filing form only for specific persons. Any non-U.S. citizen or resident who engages in business in the United States, or earns income from an American company, will have to file IRS Form 1040NR. IRS Form 1040NR is a variation of Form 1040, which taxpayers use to file their Annual Tax Return.

Who should use 1040NR?

You may need to file Form 1040-NR if you: Were a nonresident alien engaged in a trade or business in the United States. Represented a deceased person who would have had to file Form 1040-NR. Represented an estate or trust that had to file Form 1040-NR.

What happens if I filed 1040 instead of 1040NR?

If you mistakenly filed a Form 1040, 1040A or 1040EZ and you need to file 1040NR or 1040NR-EZ, or vice versa, you will need to amend your return. Per the IRS Instructions for Form 1040X Amended U.S. Individual Income Tax Return, page 5: Resident and nonresident aliens.

What is a 1040N?

Form 1040N - Individual Income Tax Return. Form 1040N - Federal Tax Liability Worksheet. Form 1040N-ES - Estimated Income Tax Payment Voucher. Form 1040N-V - Payment Voucher.

Is 1040 the same as 1040NR?

IRS Form 1040NR is a variation of Form 1040, which taxpayers use to file their Annual Tax Return. This variation is for individuals who are not American citizens and who do not pass the Substantial Presence Test. IRS Form 1040NR is also known as the U.S. Nonresident Alien Income Tax Return.

Who needs to file 1040-NR?

You may need to file Form 1040-NR if you: Were a nonresident alien engaged in a trade or business in the United States. Represented a deceased person who would have had to file Form 1040-NR. Represented an estate or trust that had to file Form 1040-NR.

Is h1b a 1040 or 1040NR?

H-1B aliens who are U.S. resident aliens for the entire taxable year must report their entire worldwide income on Form 1040, U.S. Individual Income Tax Return, in the same manner as if they were U.S. citizens.

What is 1040 tax for?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my nebraska income tax forms in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your the 1040n form is an you meet all necessary requirements and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I complete nebraska nonresident filing requirements online?

Completing and signing nebraska state tax form online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I complete nebraska filing requirements nonresident on an Android device?

Complete nebraska 1040 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is 1040n?

The 1040N is a specific tax form used by residents of Nebraska to report their income, calculate their state tax liability, and claim any credits or deductions available under Nebraska law.

Who is required to file 1040n?

Residents of Nebraska who have earned income, are required to file a state income tax return, and meet the income thresholds set by the Nebraska Department of Revenue must file the 1040N.

How to fill out 1040n?

To fill out the 1040N, taxpayers need to provide their personal information, report their income from various sources, claim applicable deductions and credits, and calculate their total tax liability using the form's instructions.

What is the purpose of 1040n?

The purpose of the 1040N is to provide a standardized way for Nebraska residents to report their income and determine their tax obligations to the state.

What information must be reported on 1040n?

The 1040N requires reporting information such as personal identification details, total income, adjustments to income, tax credits, deductions, and the resulting tax liability.

Fill out your 1040n form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nebraska State Tax Forms is not the form you're looking for?Search for another form here.

Keywords relevant to nebraska income tax

Related to ne tax forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.